- Sense per Point

- Posts

- 💳 Shitty Citi, A Decent Rakuten Card & More News and Deals from Sense per Point ✈️

💳 Shitty Citi, A Decent Rakuten Card & More News and Deals from Sense per Point ✈️

Making Sense of Points & Miles :)

100k signup bonuses: The Southwest credit cards are offering a limited time 100k signup bonus! It’s not entirely positive news, as this does coincide with annual fee increases, etc. but could be a decent pickup if you need the points 👍️

Welcome Back!

Hope everyone is doing well 😊

Since I started this newsletter, I’ve used AI only once, to generate an image of a candy airplane. I’ve decided from that moment forward that this newsletter will be AI-free, so all images will be real photographs/screenshots, and all content is written by me 👍️

However, that doesn’t mean AI hasn’t permeated the travel space. ChatGPT is pretty good when it comes to travel itineraries, and now it turns out Delta may be using AI to price flights on an individual basis. That’s scary…

Obviously, there are lots of question marks as to how that’s implemented, whether there are privacy concerns (I mean, duh, there are tons of privacy concerns here), and more. But despite all this, lots of rewards programs still use award charts, so AI won’t be touching those for now. Use your points and travel when the times are still (relatively) good!

With that, let’s get into today’s stories!

In today’s edition:

💩 AtroCiti 🏦

🏦 Transfer Bonuses ✈️

💳️ The New Rakuten Card 💳️

💳️ Best Card Signup Bonuses 💳️

💩 AtroCiti 🏦

Photo by Declan Sun on Unsplash

Just last week, I said Citi has a chance to gain a foothold in this space. In my eyes, they’ve squandered that chance 👎️

Lots of details, including for a brief moment on Citi’s own website, were released, and it looks like this for the new Strata Elite card:

Signup Bonus: 100,000 ThankYou points after $4K spend in 3 months

Annual Fee: $595

Citi Gold customers: $145 rebate (e.g. $450 annual fee after rebate)

Citi Private Client customers: first year $595 rebate, then $145 rebate each year thereafter.

Authorized User Fee: $75

Earning rate:

12x on hotels, car rentals, and attractions booked through Citi Travel®

6x on air travel booked through Citi Travel®

6x on restaurants, for purchases authorized between Friday 6:00 PM through Saturday 6:00 AM ET, and Saturday 6:00 PM through Sunday 6:00 AM ET (“Citi NightsSM ”).

3x on restaurants, for purchases authorized at any time outside of Citi Nights.

1.5x on all other purchases, including the purchases excluded below.

Credits:

$300 Annual (Calendar Year) Hotel Benefit via Citi Travel

Once per calendar year, enjoy up to $300 off a hotel stay of 2 nights or more when booked with Citi Travel

$200 Annual Splurge Credit℠

Currently available to use on AA and on Live Nation

$200 in Annual Private Chauffeur Credit with Blacklane®

Up to $100 January through June

Up to $100 July through December

Additional Benefits:

Priority Pass Select Membership

NO Restaurants

Authorized users get their own membership

Four American Airlines Admirals Club passes each year

Up to $120 Global Entry® or TSA PreCheck® Application Fee Credit

There’s a lot to digest up there! But some initial thoughts from me after seeing this:

🤷 The Citi Double Cash, for no annual fee, already offers 2x on all spend - why not have this just match that rather than give 1.5x for all spend at a higher fee??

🍽️ Citi Nights sounds interesting, but would I get this card just to get 6x points on dining just for Fridays and Saturdays? idk…

🛋️ No restaurants on the Priority Pass access is a bummer.

It just looks like Citi also went for the coupon book approach that the other cards went for, but just picked worse coupons. Of course, I don’t speak for everyone, but I don’t really use private chauffeurs, and I don’t book hotels using third-party platforms very often. So this is a dud for me. It also just doesn’t stand out to me against its competitors in the marketplace.

Do let me know if I’m being too harsh on this card, but this is either a no-go for me, or a cancel in year 2 card to churn the bonus. I also think the multipliers are just better on the $95 Strata Premier, no?

Well, Citi, I really thought for a moment you’d come up with something interesting. Now we wait until the Amex Platinum gets shaken up, and then we’ll have the full picture of what the “luxury and premium” credit cards look like.

Best of luck, all 🤞

🏦➡️✈️ Transfer Bonuses

A chart of transfer partners by bank, along with other information, can be found here!

Bank | Transfer Partner | Bonus | This bonus ends: |

|---|---|---|---|

Amex1 | Avianca Lifemiles | 15% (1:1.15) | July 31st, 2025 |

Chase | Marriott Bonvoy | 50% (1:1.50) | August 15th, 2025 |

Citi1 | Leading Hotels of the World | 25% (4:1) | August 23rd, 2025 |

1 New transfer bonuses not present during the previous week are bolded.

💳️ The New Rakuten Card 💳️

I’ve gone on and on about Rakuten on this newsletter - it is free to use, and it gives you cash back for certain online purchases, that can then be converted into Amex points to use! 💸

The old Rakuten card also wasn’t too bad, but this new Rakuten card is also interesting, and I thought it’d be worth a look! I mean, you’re essentially earning Amex MR points when spending on the card, right?

So some details of the card:

No annual fee

$25 signup bonus for spending $500 within 90 days

Card earnings:

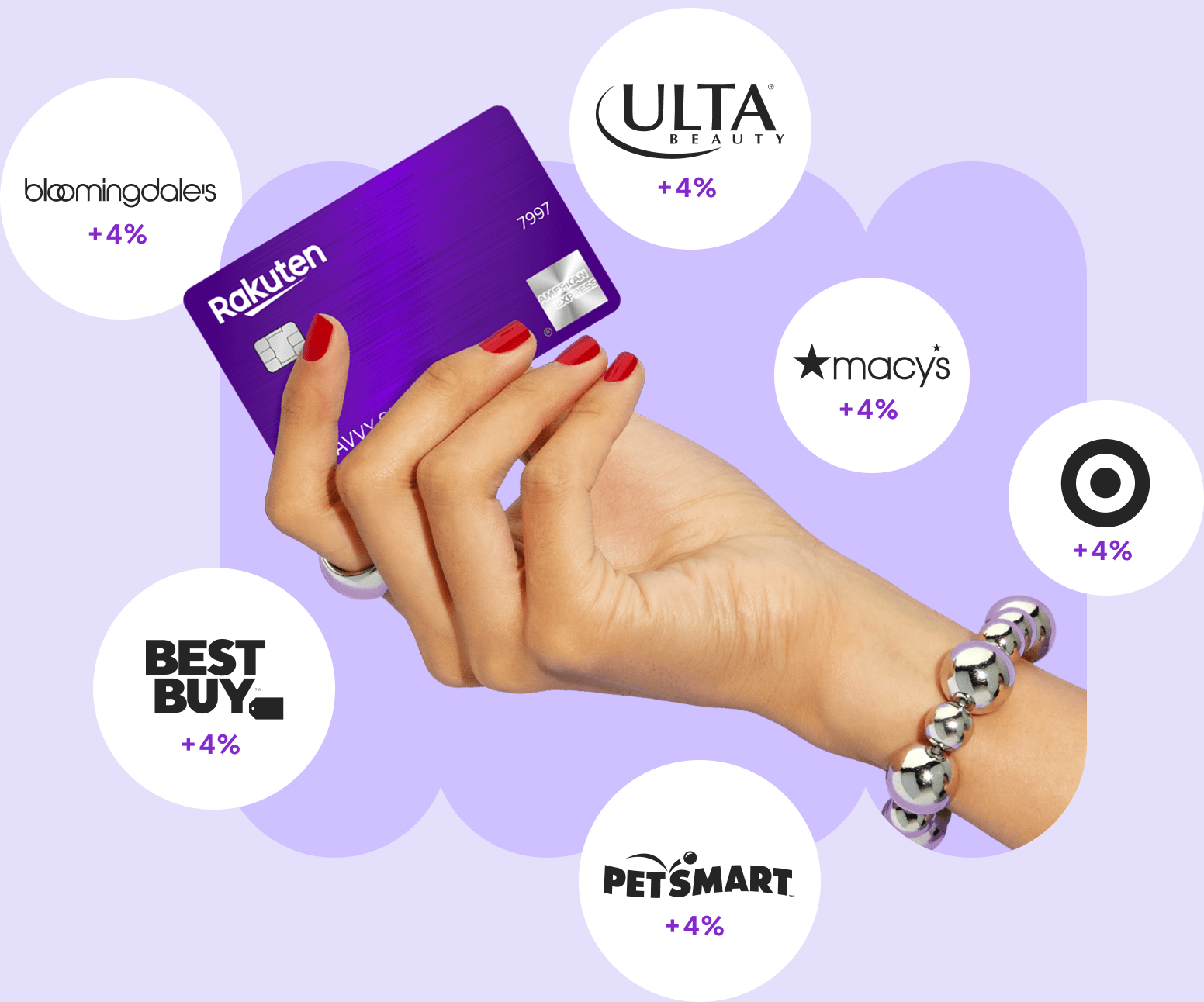

Extra 4% cash back on top of what you already earn while shopping on Rakuten’s platform of more than 3,500 stores (in-store or online), for the first $7,000 of spend per calendar year (1% afterwards).

Extra 5% cash back on top of what you already earn with Rakuten Dining. That’s a total of 10% cash back on Rakuten Dining.

2% cash back on Grocery and Restaurants.

1% cash back on all other purchases.

It’s a pretty straightforward card, although I do wish that signup bonus was a bit more than $25 or 2,500 Amex points.

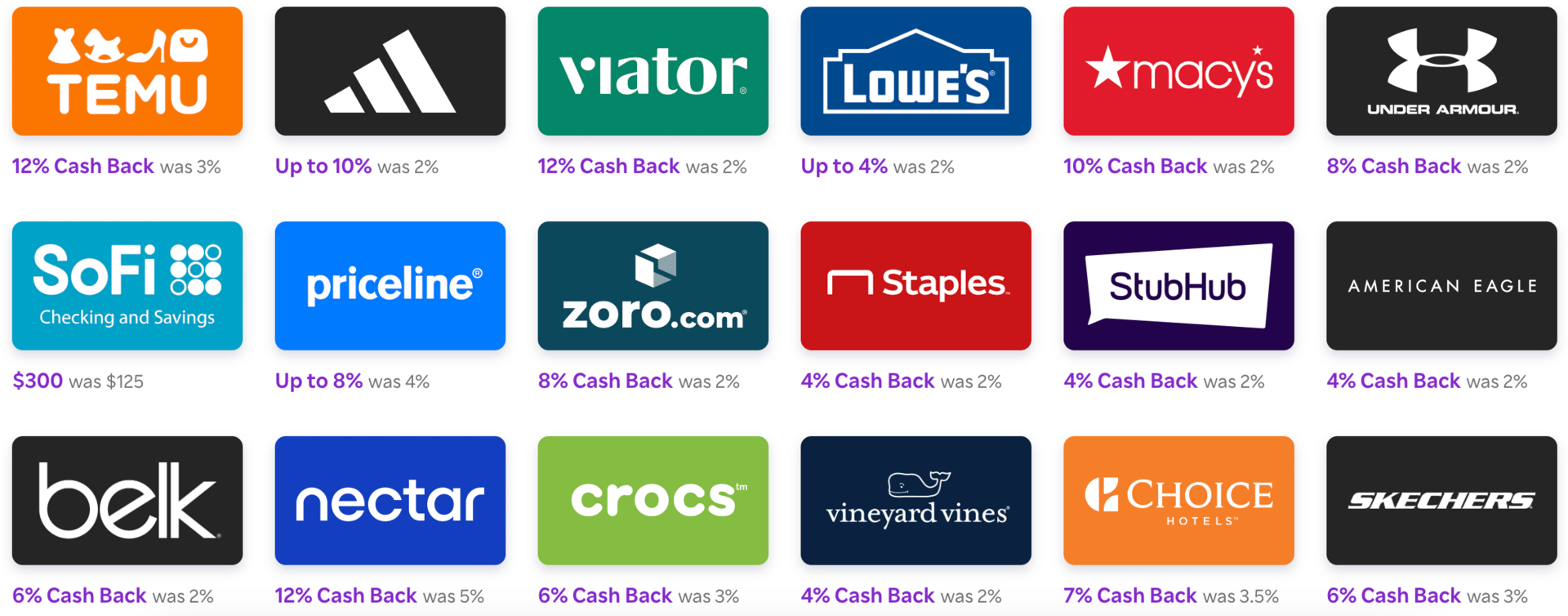

But where the real value lies is in that extra 4% cash back on top of existing earnings on Rakuten. To clarify, the below are some of the online merchants offering bonus cash back through Rakuten:

If I buy something at Viator, for example, that’s 12% back. But if I buy that with this new Rakuten card, that’s an extra 4% back, for 16% total. This is all convertible to Amex MR points, so thats a whopping 16x per dollar spent on this purchase! 💰️

Rakuten Dining also represents some good value here, as it already offers 5% back on participating restaurants. Then to add another 5% on top of that with the card means 10% cash back on dining, or 10x Amex MR points per dollar spent. Pretty good! 🍞

I’ve eaten at restaurants that were participating in Rakuten dining without realizing it, and then later receive the cash back in my account. Doing that with this card would double the cash back!

If you do any online shopping and you don’t have Rakuten yet, I do recommend it, strongly. If you already have it and use it a lot, this card may be for you. I’m considering it a bit myself!

📰 Other Stories & Deals 💰️

💙 JetBlue is offering 25% off base fares until tomorrow, with code SAVE25!

🌬️ Breeze is offering 35% off base fares until tomorrow, with code BOUNCE!

💳️ Best Card Signup Bonuses 💳️

Again, the usual solid cards:

Do search for public links for the above cards to compare signup bonuses to make sure you get the highest one (incognito mode, Resy, etc.).

For cards with elevated signup bonuses (targeted bonuses are not included), I’ve got:

Card | Bonus | Annual Fee | Why Consider? |

|---|---|---|---|

Varies from 100k-175k points after $2k-$10k spend in 6 months | $0-$550 | Elevated Bonuses for the Hilton lineup! | |

80k American miles after $3.5k spend in 4 months | $0 for first year, then $99 | 80k American miles without an annual fee! Great card to churn and cancel in year 2 | |

5 free night certificates after $5k spend in 3 months | $95 | 5 free nights, worth up to 250k points! This bonus expires July 16th. | |

85k Aeroplan miles after $4k spend in 3 months | $95 | imo the best signup bonus seen on this card in a while! | |

60k Virgin Points after $4k spend in 3 months | $99 | This is usually 40k points, so a higher bonus than usual! Solid “cancel in year 2” candidate here. |

📤️ Spread the Word! 📤️

Thanks for subscribing! This newsletter is committed to helping you maximize your points and rewards, at no direct cost to you! (appreciate you using any of my referral links, though!)

If you do find this newsletter informative, helpful, or entertaining, I’d greatly appreciate you spreading the word about it! If not, please do give me feedback on how I can improve your Sense per Point experience.

Also, if my newsletter helps you to book travel using points, let me know! It’ll make me so happy 😄

Hope that all makes sense! That’s all for this week’s edition of Sense per Point.

Wishing everyone a wonderful rest of your day and week 😊

- Sean Kim

PS: If you want to make sure Sense per Point doesn’t get caught in your spam, you can move this email to your primary inbox, or Reply “Hello!” directly to this email by clicking the link and hitting send 📩

Reply