- Sense per Point

- Posts

- 💳 A New Card, Maybe More Devaluations & More News and Deals from Sense per Point ✈️

💳 A New Card, Maybe More Devaluations & More News and Deals from Sense per Point ✈️

Making Sense of Points & Miles :)

Flash Sales: Delta is running a flash sale on some roundtrip flights from the US to Europe, and JetBlue is also running a winter sale! Book by today for JetBlue’s sale, and by tomorrow for Delta’s sale! 💰️

Welcome Back!

Hope everyone is doing well 😊

Earlier this week is also Lunar New Year, so if you celebrate that, hope that was a good time! I myself will be having some dim sum tonight to celebrate 🥟

Speaking of eating out, the Amex Gold really is quite the card for dining - it comes with a $50 restaurant credit from January-June at restaurants on Resy, and I used my credit for this half of the year without even realizing it! The best credit card benefits are the ones that you can use without adjusting your spending behavior 👍️

In today’s edition:

🏦 Transfer Bonuses ✈️

💳️ Best Card Signup Bonuses 💳️

💳️ A New Card, and Rumors of More? 💳️

There’s a new credit card out on the market, and some rumors of other cards coming later in the year, so I thought I’d go through it!

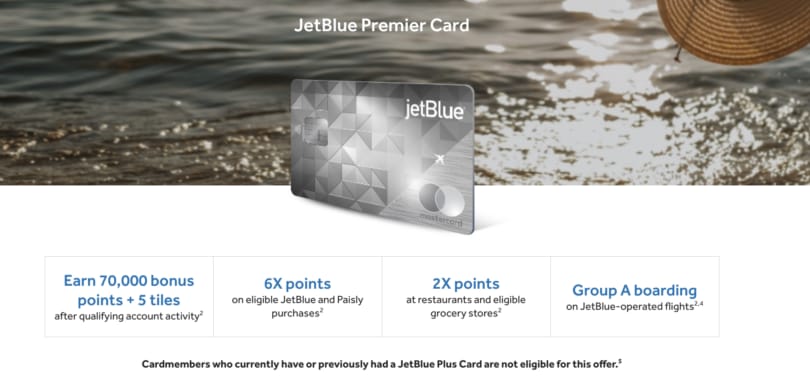

JetBlue has released the JetBlue Premier Card, which is the premium card to complement the JetBlue Plus Card that is already in the market. The card’s benefits include (but are not limited to):

$499 annual fee ($150 for authorized cardholders)

Up to $300 in statement credit per calendar year on Paisly purchases, in $50 increments for every purchase over $250 (up to 6 purchases on Paisly)

Priority Pass Select

Card earns 6x points on JetBlue & Paisly purchases

Group A boarding

Free checked bag

Having read those benefits, there’s absolutely no way that card should cost $499. Paisly, by the way, is JetBlue’s travel portal for hotels, packages, etc. Having to spend up to $1500 to get the full $300 credit from the card is quite ridiculous. Even after that, the rest of the $199 isn’t enough to justify the rest of the benefits either, in my view. Overall, a very clear dud 💩

Well, you know, not every credit card out there and not every new card can be all bright and rosy - there’s got to be some stinkers in there too! 🫢

Anyhow, enough of that disappointment - Sofi is releasing a new hotel card later this year!

Most large hotel chains already have existing cards and partnerships with banks (Hilton X Amex, Hyatt X Chase, etc.), so I was running my brain to see which hotel brand was left for Sofi’s card. Turns out that the Sonesta Card offered by Bank of America is not currently accepting applications! That usually indicates some change coming up, so that’s my guess for now.

Hopefully Sofi’s card release is better than what JetBlue and Barclays just put out! 🤞

🏦➡️✈️ Transfer Bonuses

Bank | Transfer Partner | Bonus | This bonus ends: |

|---|---|---|---|

Bilt (click the link for more details on this bonus) | Avianca Lifemiles | 20%-100% depending on your Bilt Status | (starts and ends): February 1st, 2025 |

📉 Did Marriott Devalue? 🏨

The JW Marriott Masai Mara, a beautiful property that just got pricier on points…

I wrote last week about some devaluations to Flying Blue and Qantas (Qantas only announced a devaluation, but won’t go into effect until August). Unfortunately, we may potentially be seeing another devaluation unfold before us…

Some bloggers are reporting that Marriott may have devalued, citing some increased costs at certain Marriott properties. This seemed to have happened mainly at high-end properties, which typically offer some great points redemption opportunities, so this is bad news…

This is also another reason we don’t like dynamic pricing (which Marriott uses): They can raise costs at any time without notice, so it leaves the investigative work of a devaluation to the customer. At least Flying Blue and Qantas told us what they were doing when they devalued. The further a program like Marriott goes into dynamic pricing, the less incentivized they are to be transparent about these changes 😭

Some examples of observed changes include:

JW Marriott Marai Mara’s pricing went from 100k-150k points per night to more than 200k points per night

The Algonquin Hotel Times Square went from ~76k points per night to ~85k points per night

Many other Ritz-Carlton and St. Regis properties have gone over the previous 150k cap

But then again, if other Marriott properties didn’t their redemption rates, maybe this isn’t a devaluation? It’s just so annoying that I can’t know for sure!! Either way, hoping that some of the more “ordinary” properties did not increase their prices.

Again, devaluations are becoming a bigger and bigger part of the points and miles game, as these changes also show. As I’ve said before, even with the worst of devaluations, there will always be value somewhere else, and I promise to share that value if I find it! I also personally don’t interact with Marriott, so this doesn’t affect me very much. Who wants to get Bonvoyed anyways?

📰 Other Stories & Deals 💰️

🤝 Frontier and Spirit are maybe trying a merger again??

✈️ If you fell short of American Airlines status, see if you can buy up to it here!

🇵🇹 JetBlue miles can now be redeemed on TAP Air Portugal flights!

💳️ Best Card Signup Bonuses 💳️

Again, the usual solid cards:

Do search for public links for the above cards to compare signup bonuses to make sure you get the highest one (incognito mode, Resy, etc.).

For cards with elevated signup bonuses (targeted bonuses are not included), I’ve got:

Card | Bonus | Annual Fee | Why Consider? |

|---|---|---|---|

65,000 points after $4000 in spend in 3 months | $550 | Slightly raised from the usual signup bonus, and a popular and solid credit card at that! | |

75,000 points after $4000 in spend in 3 months | $95 | Elevated signup bonus from what might be Citi’s best credit card at the moment! | |

$2,000 or 200,000 points after $30,000 in spend in 3 months | $150 | A big bonus for big business spenders! | |

70,000 American Airlines miles after your first purchase and paying the annual fee | $99 | This elevated signup bonus is ridiculously easy to hit 🎯 | |

70,000 Alaska miles and a companion fare after $3k spend in 3 months | $95 | New bonus for a great rewards program! | |

170,000 points after $4k spend in 3 months | $99 | A new bonus for a card that pays for itself every year! |

📤️ Spread the Word! 📤️

Thank you so much for subscribing! This newsletter is committed to providing you all with helpful info and tips to maximize your points and rewards, at no direct cost to you! (appreciate you using any of my referral links, though!)

If you do find this newsletter informative, helpful, or entertaining, I’d greatly appreciate you spreading the word about it! If not, please do give me feedback on how I can improve your Sense per Point experience.

Also, if my newsletter helps you to book travel using points, let me know! It’ll make me so happy 😄

Hope that all makes sense! That’s all for this week’s edition of Sense per Point.

Wishing everyone a wonderful rest of your day and week 😊

- Sean Kim

PS: If you want to make sure Sense per Point doesn’t get caught in your spam, you can move this email to your primary inbox, or Reply “Hello!” directly to this email by clicking the link and hitting send 📩

Reply